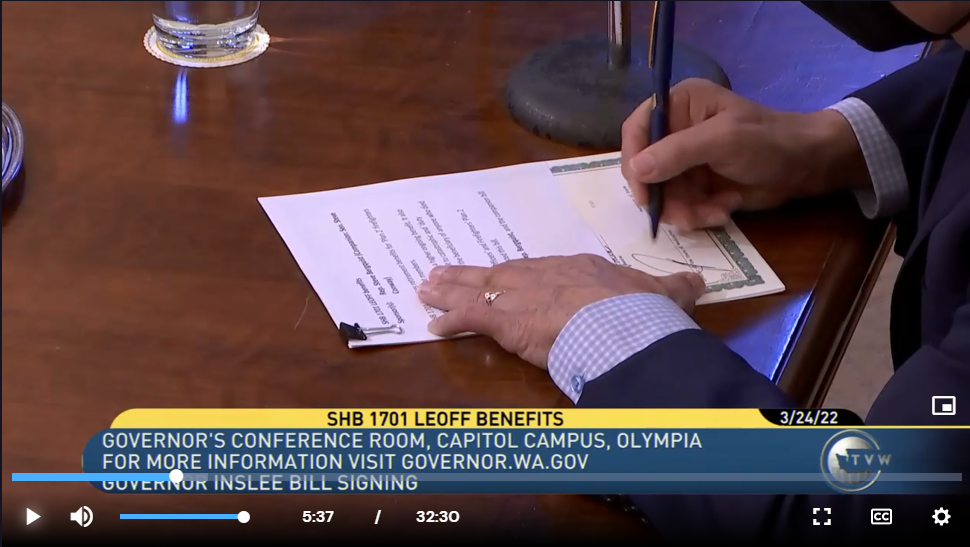

On Thursday, March 24, Governor Jay Inslee signed into law Substitute House Bill 1701, providing a significant pension benefit for members of Law Enforcement Officers and Fire Fighters LEOFF Plan 2, and making WSCFF history. Years of lobbying and relationship building resulted in the unanimous passage of this pension reform legislation. “This has been a work in progress for a long time,” said WSCFF President Dennis Lawson, “and I’m thankful to have been a part of the legislative team — Legislative Liaisons AJ Johnson and Bud Sizemore, Secretary-Treasurer Greg Markley, Vice President Dean Shelton, and Session Lobbyist Erin Johnson — that was able to get this done. This team continues to advocate for pension, collective bargaining, safety, and other issues important for our members.”

Lawson went on to say that the groundbreaking work that created the LEOFF Plan 2 Retirement Board paved the way for this success. Until 2003, it was difficult for LEOFF Plan 2 members to get information about how their pensions were managed and operated. In 2002, the WSCFF and its law enforcement partners mounted a massive, statewide effort that resulted in the passage of Initiative 790 giving fire fighters and police officers six seats on the 11-member LEOFF Plan 2 Retirement Board. “We would not be here today without the strong leadership of those who came before us,” Lawson said, “Because of their work, the LEOFF Plan 2 Retirement Board has created a model our members can be proud of, and others should emulate.”

SHB 1701 modifies the pension formula for current and future LEOFF Plan 2 members. Members who retired on or before February 1, 2021, will receive a lump sum of $100 per service credit month worked; current members have the lump sum option or an extra 0.5% pension multiplier for service years 16 to 25; and future members will have the increased pension multiplier for their 16th to 25th years of service. Many WSCFF members retire before they are eligible for federal benefits like Medicare. This improved benefit will help bridge that gap and ensure a better quality of life post-retirement.

IAFF 7th District Vice President Ricky Walsh said, “Our WSCFF brothers and sisters have been working toward this reform for more than two decades. I am very proud of their perseverance and dedication, never losing sight of this important goal for the membership.”

Following the passage of Initiative 790, with better access to pension-related operations, WSCFF leaders looked for ways to improve retiree benefits and have passed more than 25 incremental improvements prior to the 2022 Legislative Session.

In 2008, WSCFF leaders successfully lobbied for the passage of legislation that created a benefit improvement account for LEOFF 2 members. The legislation called for money to be deposited in the account from the state’s general fund when state revenues exceeded the previous fiscal biennium revenue by more than five percent.

The LEOFF 2 retirement fund was performing so well that it was more than 100% funded in 2019. The WSCFF successfully lobbied for the passage of legislation that authorized the state treasurer to transfer $300 million from the LEOFF 2 retirement fund into the benefit improvements account.

As a result of the transfer, the LEOFF Plan 2 Retirement Board had the opportunity to establish a larger benefit for the members. This–and the tireless effort of the WSCFF Legislative Team–ultimately led to the drafting and passage of SBH 1701.

Update: Benefit Improvement FAQs Available

Department of Retirement Systems and the LEOFF 2 Board staff has developed a list of FAQs for your review. Below are tables breaking down which groups of LEOFF Plan 2 members qualify for the lump sum benefit improvement, tiered multiplier benefit improvement, choice between lump sum benefit or tiered multiplier benefit, or no benefit improvement. This list does not specify all potential situations. DRS will keep their Benefit Improvement Page updated as the latest information on implementation becomes available.

RETIRED AS OF 2/1/21

| LEOFF 2 Member Group | Benefit Improvement |

|---|---|

| Retired as of 2/1/21 | Lump sum |

| Duty or catastrophic disability retired as of 2/1/21 | Lump sum (minimum of $20k) |

| Beneficiary of line-of-duty death who died prior to 2/1/21 | Lump sum (minimum of $20k) |

| Survivor beneficiary, member deceased as of 2/1/21 | Lump sum |

| Member deceased as of 2/1/2021 with no survivor beneficiary | No benefit |

| Withdrawn | No benefit |

LEOFF 2 Member Active as of 2/1/21

| LEOFF 2 Member Group | Benefit Improvement |

|---|---|

| Still active | Choice of lump sum or tiered multiplier |

| Now retired | Choice of lump sum or tiered multiplier |

| Duty or catastrophic disability retirement | Choice of lump sum (minimum of $20k) or tiered multiplier |

| Beneficiary of line-of-duty death who was active as of 2/1/21 | Choice of lump sum (minimum of $20k) or tiered multiplier |

| Survivor beneficiary, member deceased after 2/1/21 | Choice of lump sum or tiered multiplier |

| Survivor beneficiary in service death not line-of-duty | Choice of lump sum or tiered multiplier |

| No survivor beneficiary, member deceased after 2/1/21 before effective date of the bill | Lump sum to beneficiary or estate |

| No survivor beneficiary in service death not line-of-duty | Lump sum to beneficiary or estate |

| Withdrawn | No benefit |

| Inactive as of 2/1/21 and vested | Choice of lump sum or tiered multiplier |

| Inactive and not vested | No benefit |

| Inactive and not vested as of 2/1/21, returns to LEOFF employment after 2/1/21 and becomes vested | Choice of lump sum or tiered multiplier |

NEW MEMBER AFTER 2/1/21

| LEOFF 2 Member Group | Benefit Improvement |

|---|---|

| New members after 2/1/21 | Tiered Multiplier |

| Withdrawn | No benefit |